Artificial Intelligence in Finance

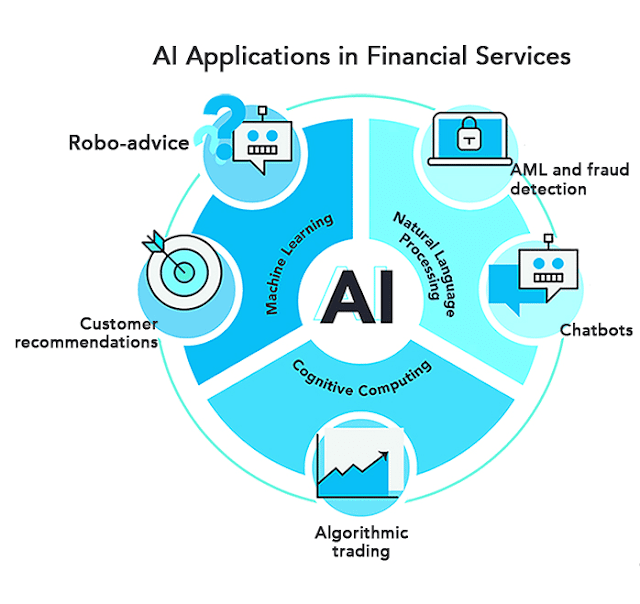

The application of artificial intelligence (AI) and machine learning algorithms in areas such as algorithmic trading, credit scoring, fraud detection, and customer service is transforming the financial industry. Discussions may focus on the benefits, ethical considerations, and potential risks associated with AI adoption.The application of artificial intelligence (AI) and machine learning algorithms in areas such as algorithmic trading, credit scoring, fraud detection, and customer service is transforming the financial industry. Discussions may focus on the benefits, ethical considerations, and potential risks associated with AI adoption.

Algorithmic Trading and Quantitative Analysis: AI-powered algorithms continue to play a significant role in algorithmic trading and quantitative analysis. Machine learning models analyze vast amounts of financial data to identify patterns, trends, and trading signals, enabling faster and more accurate decision-making in financial markets.

Predictive Analytics and Market Forecasting: AI-driven predictive analytics models are increasingly used for market forecasting, risk assessment, and portfolio optimization. Advanced machine learning techniques analyze historical market data, economic indicators, and alternative data sources to generate predictive insights on asset price movements, market trends, and investment opportunities.

Robo-Advisors and Automated Wealth Management: Robo-advisors leverage AI and machine learning algorithms to provide automated investment advice, portfolio management, and financial planning services to retail investors. These digital platforms offer personalized investment strategies, risk assessment tools, and automated rebalancing features, democratizing access to wealth management services and lowering investment costs.

Credit Scoring and Underwriting: AI-powered credit scoring models revolutionize the lending industry by improving credit risk assessment and underwriting processes. Machine learning algorithms analyze diverse data sources, including transaction history, alternative credit data, and social media activity, to assess borrowers' creditworthiness and make faster lending decisions with greater accuracy.

Fraud Detection and Anti-Money Laundering (AML): AI technologies enhance fraud detection and AML compliance efforts by identifying suspicious activities, transaction patterns, and fraudulent behaviors in real-time. Machine learning models analyze transaction data, customer profiles, and behavioral patterns to detect anomalies and potential fraud indicators, enabling financial institutions to mitigate risks and comply with regulatory requirements.

Customer Service and Chatbots: AI-powered chatbots and virtual assistants transform customer service in the financial industry, providing personalized support, account inquiries, and financial advice to customers through conversational interfaces. Natural language processing (NLP) algorithms understand and respond to customer queries, automate routine tasks, and improve overall customer experience and satisfaction.

Risk Management and Portfolio Diversification: AI-driven risk management solutions help financial institutions identify, assess, and mitigate various types of risks, including market risk, credit risk, and operational risk. Machine learning models analyze portfolio performance, market dynamics, and macroeconomic factors to optimize asset allocation, manage risk exposure, and enhance portfolio diversification strategies.

Regulatory Compliance and Governance: AI technologies assist financial institutions in regulatory compliance and governance by automating compliance monitoring, regulatory reporting, and audit trail analysis. Machine learning algorithms analyze regulatory requirements, identify compliance gaps, and generate insights to ensure adherence to applicable laws, regulations, and industry standards.

Personalized Financial Services and Product Recommendations: AI-powered recommendation engines deliver personalized financial services and product recommendations to customers based on their financial goals, preferences, and behavior patterns. Machine learning algorithms analyze customer data, transaction history, and market trends to offer tailored recommendations for banking products, investment opportunities, insurance policies, and retirement plans.

Ethical and Responsible AI Practices: As AI adoption in finance grows, there is increasing emphasis on ethical and responsible AI practices to address concerns related to fairness, transparency, and bias in algorithmic decision-making. Financial institutions prioritize ethical AI frameworks, algorithmic accountability, and diversity and inclusion initiatives to ensure that AI systems are designed, developed, and deployed in a responsible and ethical manner.

No comments:

Post a Comment